A few weeks ago, The Economist published its annual Big Mac Index. This has been a long-standing exercise by that newspaper to examine how close current exchange rates were to purchasing power parity (or PPP). The idea is to take a standardised commodity that is otherwise locally produced and compare prices across countries. According to PPP, exchange rates should adjust so that in the long-run, the purchasing power of a consumer across countries is the same. Big Mac prices (and perhaps Starbuck's Tall Latte prices) can, therefore, give an indication as to where PPP exchange rates should be.

One feature of Big Mac prices is that they, of course, build in variation in local costs. Put simply, the price of beef is lower in Australia than Japan and always will be. What one really needs is a standardised commodity that is free of variations in local costs.

It occured to me that iTunes individual song downloads were such a commodity. Like Big Macs their pricing is set by a single firm. But unlike Big Macs we can expect that there are no local variations in costs as for a given song it is the same music company that negotiations with Apple. Hence, all price variation is likely to be demand related.

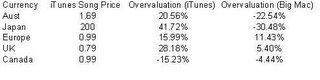

There are many iTunes stores but only six distinct local currency prices (USA, Europe, UK, Japan, Canada and Australia). The following table is my calculation of the iTunes Index and based on today's exchange rates what the suggested over or undervaluation of each currency (relative to the US dollar) is:

One feature of Big Mac prices is that they, of course, build in variation in local costs. Put simply, the price of beef is lower in Australia than Japan and always will be. What one really needs is a standardised commodity that is free of variations in local costs.

It occured to me that iTunes individual song downloads were such a commodity. Like Big Macs their pricing is set by a single firm. But unlike Big Macs we can expect that there are no local variations in costs as for a given song it is the same music company that negotiations with Apple. Hence, all price variation is likely to be demand related.

There are many iTunes stores but only six distinct local currency prices (USA, Europe, UK, Japan, Canada and Australia). The following table is my calculation of the iTunes Index and based on today's exchange rates what the suggested over or undervaluation of each currency (relative to the US dollar) is:

There are two things interesting to note here. First, apart from Canada, iTunes songs are priced at a premium in other music stores. This echoes my observations about the Australian iTunes music store in The Age (4th November, 2005) where I noted the substantially higher prices for all iTunes products (if they were available) in Australia as compared with the US. Second, there is no relationship between the PPP implied exchange rates under the iTunes and Big Mac indeces. Indeed, there isn't even a qualitative consistency.

What is interesting about all of this is that I suspect it is the iTunes pricing -- something that was fixed but also was set as iTunes rolled out -- that is a poor predictor of PPP rather than Big Mac pricing that is flexible and also has a longer-term history. This suggests that iTunes may face some painful pricing reallignment in the future. Certainly, I do not expect exchange rates to adjust to resolve the distortion.

Of course, this might also suggest that it is just the US price that was set poorly. For instance, according to the Big Mac prices, the Australian dollar is overvalued with respect to the Yen but for iTunes, there is no overvaluation or undervaluation.

Nonetheless, if I am wrong and Apple based its iTunes pricing optimally on long-term forecasts of exchange rates, then the iTunes Index should outpredict the Big Mac Index for exchange rate movements as it is free of local variation. I guess time will tell on that one.

1 comment:

Another problem with using iTunes is the uncertainty factor. When it was started in the US, the record companies had no idea how successful it was going to be, and probably didn't think it would work (as you could just use napster et al to download the thing for free). So It's wasn't bargaining so hard, and didn't realise it's own bargaining power.

As iTunes has become more popular, and the record companies realised their bargaining power, the negogiated higher proportions and prices.

If you really want to see how out of whack iTunes (and music in general) prices are divide them the price of a big mac in the same country.

So According to the big-mac index a iTunes song should cost $US 0.81c in Australia where is currently is $1.20.

But if you look at finland the price is on par with the big mac index.

Post a Comment