Thanks to

www.westwingtranscripts.com I was able to

read the following exchange in the live (but fictional) debate episode between Republican Vinick and Democrat Santos in The West Wing. I love the show but this gaff regarding who invented ulcer treatments really irked me.

Here is the relevant bit:

-------------------------------------------------------

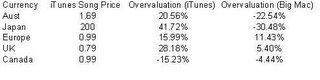

SAWYER Senator, let me ask you about a related issue which is prescription drug prices and those prices have been going up at a rate more than double the inflation rate. So, would you favor re-importing American drugs from Canada where they are much cheaper?

VINICK You know why drugs are cheaper in Canada; because the government controls the price. Do you know how many life-saving drugs are invented in Canada? None, because the government controls the price.

SANTOS Well, Canadian laboratories have helped to create some very important drugs.

VINICK No, nothing like the miraculous drugs that the American pharmaceutical industry has given to the world.

SANTOS Given to the world? I guess you haven't seen the price list lately, sir.

VINICK Not long ago, if you were HIV positive in this country you were marked for death. Not anymore. And that's thanks to our pharmaceutical companies.

You know, in the 1970s, the most common cause for surgery was ulcers. Now, you get an ulcer, you take a pill. Is it an expensive pill? Yes. A dollar does seem like a lot to pay for one pill. But how does a dollar a day sound compared to a $30,000 surgery bill? So, are prescription drugs expensive? Yes. Do they save us from getting hit with much more expensive hospital bills? Yes. Do they save lives? Yes. American pharmaceutical companies save us money and they save lives and the Democrats can not stop attacking them.

SANTOS Why should the pharmaceutical companies get protection that no other American industry gets? We can buy anything else from Canada; why not prescription drugs?

VINICK Because the Canadian price controls are unfair to American companies.

------------------------------------------------------------

Now there is alot to think about here but the bit I didn't like was the ulcer example (highlighted).

The Republican candidate was batting for protection of pharmaceutical company interests (the usual, the US people have to pay more than Canada so the companies will have an incentive to develop drugs). But he then cited as a prime example of this: the development of ulcer treatment which is now cured by a simple anti-biotic saving thousands in on-going treatment.

The problem with this example is that this treatment was discovered and developed in Australia using publicly funded research. To make matters worse, just two weeks before the live debate was aired (!), the Australians who discovered this won the

Nobel prize (that is Marshall and Warren for "for their discovery of the bacterium Helicobacter pylori and its role in gastritis and peptic ulcer disease") I am not even sure the treatment is IP protected. So this is hardly a good example of the need to protect US pharmaceutical companies against Canadian imports.

Actually, the Australian PBS system does it all -- low prices and protection of innovative returns but that is a discussion for another time.